This sounds reasonable, but will a stumble really happen?

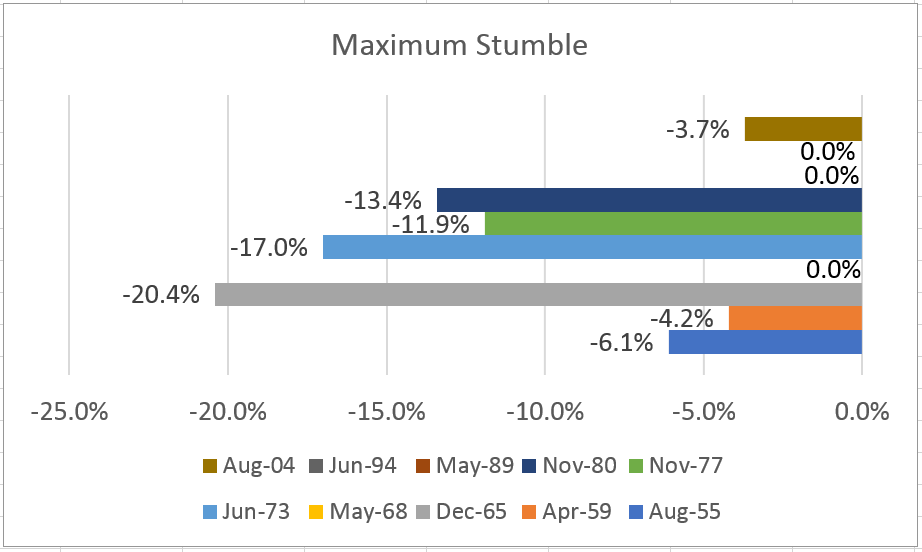

The chart below shows the S&P 500’s maximum stumble in the year after the Fed’s last 10 third rate hikes dating back to 1955. Three times after the third hike, traders were unfazed, and the S&P 500 kept moving higher, never falling lower than the low on the day of the hike. On average, we see a 7.7% decline.

The steepest declines occurred between 1965 and 1980, a time when the S&P 500 was in a broad trading range. This was when Businessweek proclaimed the death of equities, noting in 1979:

…the institutionalization of inflation — along with structural changes in communications and psychology — have killed the U.S. equity market for millions of investors. “We are all thinking shorter term than our fathers and our grandfathers,” says Manuel Alvarez de Toledo, of Shearson Loeb Rhoades Inc.’s Hong Kong office. Today, the old attitude of buying solid stocks as a cornerstone for one’s life savings and retirement has simply disappeared.That passage seems comical now. Imagine a time when stocks were avoided because investors were no longer focused on the long term. Stocks are now the ultimate short-term investment for high-frequency traders, and individual investors, such as my colleague Paul Mampilly, have shortened their average holding period for equities.

No one would say anything like what Businessweek wrote in 1979, yet the trading rule that worked during that time (three steps and a stumble) is still being widely revered.

The world has changed since 1980, the last time “three steps and a stumble” led to a significant market sell-off. Even if the Fed hikes rates four times this year, interest rates on savings will remain low by historical standards, and the stock market is likely to shrug off the hikes.

The Fed could still sink the stock market, but it would take a change in its balance sheet to do that. If for some reason the Fed started selling the trillions of dollars’ worth of bonds it’s bought since 2009, the market would almost certainly stumble. Until then, the Fed isn’t likely to be an important factor to traders.

Regards,

Michael Carr, CMT

No comments:

Post a Comment