Authors: Mark Calabria, Norbert Michel and Hester Peirce

Bank regulation is often based on the idea that banks are special because bank failures might lead to widespread economic damage due to the role of banks in the U.S. payments system. Under this theory, strict regulation—and, if this regulation fails—government backstops, are warranted. Since the 2007–2009 financial crisis, this regulatory approach has bled from banks to other types of financial firms, such as broker-dealers, insurance companies, and asset managers. Historically, these non-bank financial firms have not been painted with the same regulatory brush as banks, but the crisis marks a clear shift from the “banks are special” doctrine to the “all financial institutions are special” doctrine.Proponents of the shift worry that failures of these non-banks would lead to the same economy-wide problems they fear from bank failure. According to this perspective, dividing regulatory authority among different agencies that take different regulatory approaches weakens regulation, invites arbitrage, and prevents any single regulator from having a clear picture of the overall financial system. Though the U.S. financial regulatory structure needs reform, a single “super” regulator with a banking mindset and a ready safety net would not improve economic outcomes.

During its post-crisis negotiations, Congress considered creating a consolidated financial regulator.1 The ultimate product of those discussions—the Dodd–Frank Wall Street Reform and Consumer Protection Act2—did not on its face include such a super regulator. Nevertheless, Dodd–Frank, as it has taken shape during its first half-decade, is moving the financial system toward uniform regulation. If this trend continues, the system may well end up under the de facto control of a super regulator: the Board of Governors of the Federal Reserve.

The move toward more uniform financial regulation is occurring in a number of ways. First, Dodd–Frank increased the scope of the Federal Reserve’s authority to include new powers, such as an explicit systemic-risk mandate, and new supervised entities, such as savings-and-loan holding companies, securities holding companies, and systemically important financial institutions (SIFIs).3 For example, as of May 2016, the Federal Reserve had supervisory authority over approximately 25 percent (based on total assets) of the insurance industry.4

The Federal Reserve is also active in international regulatory efforts to identify and establish regulatory standards for SIFIs.5 Domestic regulators face substantial pressure to follow the international consensus regarding the regulation of individual companies and industry sectors.6 Additionally, the Financial Stability Oversight Council (FSOC)—in which federal banking regulators play an outsized role—has authority to override the decisions of individual regulators, even independent regulatory agencies.7 Finally, the Federal Reserve has been actively advocating changes outside its normal regulatory sphere.8

This chapter argues that regulatory homogenization threatens to impair the effective functioning of the financial system. Regulatory reform is needed, but should be rooted in a recognition that financial market participants and their regulators respond to incentives in the same way that participants in other markets do. This chapter lays out several structural, procedural, and policy reforms that would produce more effective financial regulation by making financial market participants, including regulators, more accountable for their actions.

Laying the Proper Groundwork for Financial Regulation

Before identifying regulatory solutions, policymakers need to consider regulatory justifications. Which problems are regulations supposed to solve? Policymakers can only design appropriate solutions after clearly answering this question. It is not enough simply to point to the potential for a financial crisis to justify a particular regulation. Likewise, a stated desire to maintain financial stability is not sufficient because nobody knows what the term means, let alone how to measure it.9 Rather, policymakers must understand the particular problems they are trying to solve before they can design effective solutions.

Common Justifications for Financial Regulation. Policymakers and regulatory advocates have identified several problems they believe financial regulation can and should address. These include threats to macroeconomic stability, consumer harm, and potential drains on taxpayer resources. Proponents argue that government regulation is the most effective way to keep all of these problems in check.

Coloring the assessment of problems and solutions is a belief that the financial industry is different from other industries. The idea that financial firms require stringent regulations because they are different from nonfinancial companies used to be confined to the banking sector.10 As the relative share of bank financing has declined, however, policymakers have extended this aura of exceptionality to virtually all forms of non-bank financing.11 Policymakers, in the name of global macroeconomic stability, also have increasingly embraced a homogenous, complex regulatory framework for the whole financial system. The approach ignores industry distinctions and national boundaries in favor of a uniform, bank-regulatory approach.

The financial system is central to the functioning of the rest of the economy, so policymakers’ concern for financial stability is not surprising. Financial firms facilitate commerce among nonfinancial firms, so failures in the financial sector could impede business activity at nonfinancial companies. Main Street is interconnected with Wall Street, and problems in the financial sector can give rise to problems in the rest of the economy. Non-financial companies, consumers, and investors all may suffer if one or more large financial firms fail. However, the very same reasoning could be used to justify heavy regulation of nonfinancial firms, which are also deeply interconnected with one another. To see this, one need only imagine the failure of a large company, such as Walmart, and the grave consequences for its millions of customers, employees, and suppliers.

In addition to financial stability, policymakers cite consumer and investor protection as a justification for an increasingly intensive financial regulatory system. Traditionally, regulators have sought to protect consumers from fraud, but consumer protection has expanded to include averting financial loss, constraining consumers’ choices for their own good, or—even more expansively—maintaining confidence in the financial sector.12 The consumer confidence justification complements the goal of ensuring macroeconomic stability.13 If consumers and investors lack confidence in the financial system, so the theory goes, the system will crumble and carry down the rest of the economy with it. Together, the macroeconomic stability and consumer protection justifications undergird calls for an expanded financial regulatory framework.

Another reason policymakers call for expanding bank-like regulation to non-banks is the need to protect the integrity of governmental financial guarantees. These guarantees are claimed to protect consumers and ensure financial stability. Both the federal and state governments provide taxpayer-backed guarantees. The main federal guarantee for the financial system is federally backed deposit insurance through the Federal Deposit Insurance Corporation (FDIC). The FDIC collects premiums from banks to establish the Deposit Insurance Fund (DIF), but the U.S. Treasury is obligated to cover any shortfall when the DIF is insufficient to cover depositors’ losses. As the 2007–2009 financial crisis illustrated, the federal government also may create special programs to assist banks and other financial firms during times of stress.14 States maintain industry-funded, but ultimately taxpayer-backed, guaranty funds that provide financial protection to insurance policyholders in the event an insurance company becomes insolvent.15 Thus, governments justify imposing strict capital and other regulations on the grounds that doing so protects taxpayers.16

On the surface it makes sense to protect taxpayers in this manner. However, the evidence shows that extensive regulation has not actually worked as intended,17 and that implementing government-backed insurance schemes has likely done more harm than good. In particular, countries with more government involvement in a deposit insurance system, and with higher levels of deposit insurance coverage, tend to have more bank failures and financial crises.18

One problem with this type of government-backed insurance is that it gives deposit holders and investors an incentive to stop carefully monitoring the risks firms are taking. This problem magnifies what is known as moral hazard, whereby government backing gives managers the incentive to take on more risk than they would without a taxpayer backstop.19 Therefore, while it seems laudable to protect taxpayers from potential losses through the DIF, an alternative to government-backed guarantees and government-imposed regulation could more readily accomplish that goal.

The moral hazard created by government guarantees can be in itself a justification for prudential regulation. Such regulation, however, is only justified when it reduces risk, whereas some regulations, like the Community Reinvestment Act, push banks to take more risks, not fewer. In many cases, the actual justification for financial regulation is not safety and soundness or the greater public interest, but the redistribution of income via the financial system. Financial regulation can also have fiscal goals, as illustrated by the favoring of sovereign debt in most regulatory schemes.

A Market-Based Approach to Financial Regulation

The goals of maintaining macroeconomic stability, protecting consumers, and exercising good stewardship over taxpayer resources provide policymakers broad cover to micromanage the financial system. Almost any regulatory intervention can hide under the shadow of one of these broad and superficially appealing themes. More precise identification of the problems at issue leads to a narrower, more tailored, and more realistic regulatory framework and leaves room for private-market-based solutions.

Financial regulation should establish the framework within which financial institutions survive and thrive based on their ability to serve consumers, investors, and Main Street companies. Financial regulators have historically punished fraud and encouraged sound disclosure, but did not micromanage decision making. Such an approach runs counter to the current macroprudential trend in regulation, which places governmental regulators—with their purportedly greater understanding of the financial system—at the top of the decision-making chain.

Experience clearly shows that the government may not be the best regulator of financial markets. The financial crisis of 2007–2009 occurred despite—and perhaps partly because of—heavy regulation.20 Government regulations can be gamed and sometimes create incentives for companies to take actions that make them less resilient. The competitive process that is a natural part of a free enterprise system is an alternative, and often more effective, way to regulate markets. Firms have to figure out how to provide products and services at prices that customers are willing and able to pay. If, for instance, bank customers value deposit insurance, firms will provide it at a price that reflects its cost. The firms that provide the insurance will monitor the insured banks. The government, by contrast, assumes that all depositors want deposit insurance, does not charge economically appropriate rates, and does not monitor banks as closely as a private insurer with money on the line would do.

Ultimately, if private firms cannot provide such insurance, consumers do not value it. To provide more market discipline and move toward such a system, Congress can lower the amount of FDIC deposit insurance coverage to (at least) the pre-Dodd–Frank limit of $100,000 per account.21 Even lowering the value to the pre-1980 limit of $40,000 per account would insure a level (based on 2014 data) nearly 10 times the average transaction-account balance of approximately $4,000.22 The same market principles apply to the extensive set of government-imposed regulations that determine banks’ capital position.

Under the current system, financial firms must conduct their business and adhere to various capital and liquidity ratios based on regulators’ subjective risk assessments. These rules impose needlessly complex requirements, and there is no reason to expect regulators to make better risk assessments than the market participants who stand to increase or lose their investments.23 Rather than forcing banks and other financial firms to adhere to arbitrary standards set by regulatory fiat, policymakers should introduce more market discipline into the system so that, ultimately, market participants can impose their own capital rules. While allowing market participants to determine the appropriate equity levels for funding still fails to guarantee a stable banking system and macroeconomy, evidence clearly shows that allowing regulators to set statutory capital requirements fails as well.24

What is more, both theory and evidence suggest that the banking system will perform better when banks’ capital suppliers face more market discipline.25 A common empirical finding is that companies that use more debt generally have to pay higher costs in order to borrow. This constrains both their ability to borrow and to grow. The exception to this finding is financial institutions that are backed by government. That backing pushes out the private monitoring of financial leverage, resulting in greater instability. The guarantee business of Fannie Mae and Freddie Mac was leveraged at more than 200 to 1.26 Such massive leverage would never occur in the absence of government guarantees.

Government simply cannot impose financial stability on the economy, and any such macro-stability objectives are best achieved through a competitive market process.27 Unlike government regulation, this process provides incentives for firms to monitor themselves, their counterparties, their competitors, and market conditions to prepare for adverse events. Markets function best when this competitive process is allowed to work, and it requires that the government allow the weakest, poorest-run firms to fail. These are the companies that do not serve their customers well, and preventing their failure works against macroeconomic stability because it prevents the migration of resources to people and companies who are better able to put them to good use.

The overall failure of government rules and regulation to create a sound system is partly due to an insurmountable knowledge problem.28 In particular, no group of experts can know precisely how to prevent future events that are themselves uncertain. Market participants cannot accomplish this task either, but the competitive process forces those with the most to lose to use their judgment. At best, government rules that profess to guarantee financial market safety create a false sense of security. Worse, over time, these rules have a tendency to increase in volume and complexity, thus protecting incumbent firms from new competitors. This outcome hinders innovation, tends to raise prices, and prevents people from learning the best ways to employ resources.

Government can play a role in protecting consumers, investors, and policyholders, particularly in mitigating and punishing fraudulent behavior. However, competitive markets have the most important role to play here. The competitive market process can, for example, help to root out fraudulent actors through monitoring and short-selling. In fact, one recent study found that short sellers “are proficient at identifying financial misrepresentation before the general investing public,” and that, even net of their profits, short sellers “generate external benefits for uninformed investors.”29 Furthermore, the competitive process is likely the best way to generate effective consumer and investor-tailored disclosures. Any reforms to the U.S. financial regulatory framework should recognize that effective regulation—regulation that rigorously and relentlessly ferrets out and punishes bad behavior—is more likely to come from markets than from government.

Misleading and fraudulent behavior for all products and services—including financial products and services—are prohibited by both state and federal law. Furthermore, while government-mandated disclosures aimed at mitigating fraud and misrepresentation are one type of regulation, they are properly viewed as distinct from regulations that dictate, for instance, the type and amount of capital that financial firms may use. Even disclosure-based regulations can be used to indirectly shape market behavior rather than to ensure that consumers and investors have the information they need to make decisions.

Market-based regulatory solutions can be more tailored, more flexible, and more effective than government mandates. Thus, as problems arise in the markets, policymakers should look for market-based solutions. Such solutions may be easier to implement if, as discussed in the next section, reforms are made to the financial regulatory structure and its degree of accountability to the American people.

The Elusive Optimal Financial Regulatory Structure

There is no perfect structure for the financial regulatory system, but design affects how well regulation is carried out, so regulatory re-designers should proceed with care. The quest for the holy grail of regulatory structure has resulted in periodic reconsideration of optimal regulatory structure in the United States and abroad, and some countries have consolidated many regulatory functions into a single financial regulator.30 Others have embraced functional regulation. The fact that countries have modified their approaches over time reflects the universal difficulty of this exercise.31 We argue against a super-regulator, but recommend some areas in which consolidation could generate improved financial regulation. We do not undertake to prescribe the precise form the U.S. regulatory structure should take, but rather to suggest broad outlines.

Avoiding a Super-Regulator

The blatant inefficiency and complexity of our regulatory system has prompted multiple efforts toward consolidation. For example, as the recent financial crisis was breaking out, the Department of Treasury issued a regulatory reform blueprint that posited an “optimal” regulatory structure as comprising three regulators—responsible respectively for “market stability regulation, safety and soundness regulation associated with government guarantees, and business conduct regulation.”32 This so-called objectives-based approach is attractive in its potential to eliminate regulatory arbitrage, but it also could aggravate the current tendency of bank regulation to seep into capital markets regulation. In other words, such a re-organization could further open the door for the banks-are-special doctrine to expand into the all-financial-institutions-are-special doctrine. After the financial crisis, Treasury issued another report, this time calling for a less-streamlined regulatory approach.33 Under the latter approach, Treasury called for one national bank supervisor, a new consumer regulator, expanded powers for the Federal Reserve, and a new systemic risk council.34 At the time, Congress also contemplated big changes, such as the merger of the SEC and Commodity Futures Trading Commission (CFTC),35 and the creation of a super-regulator.36

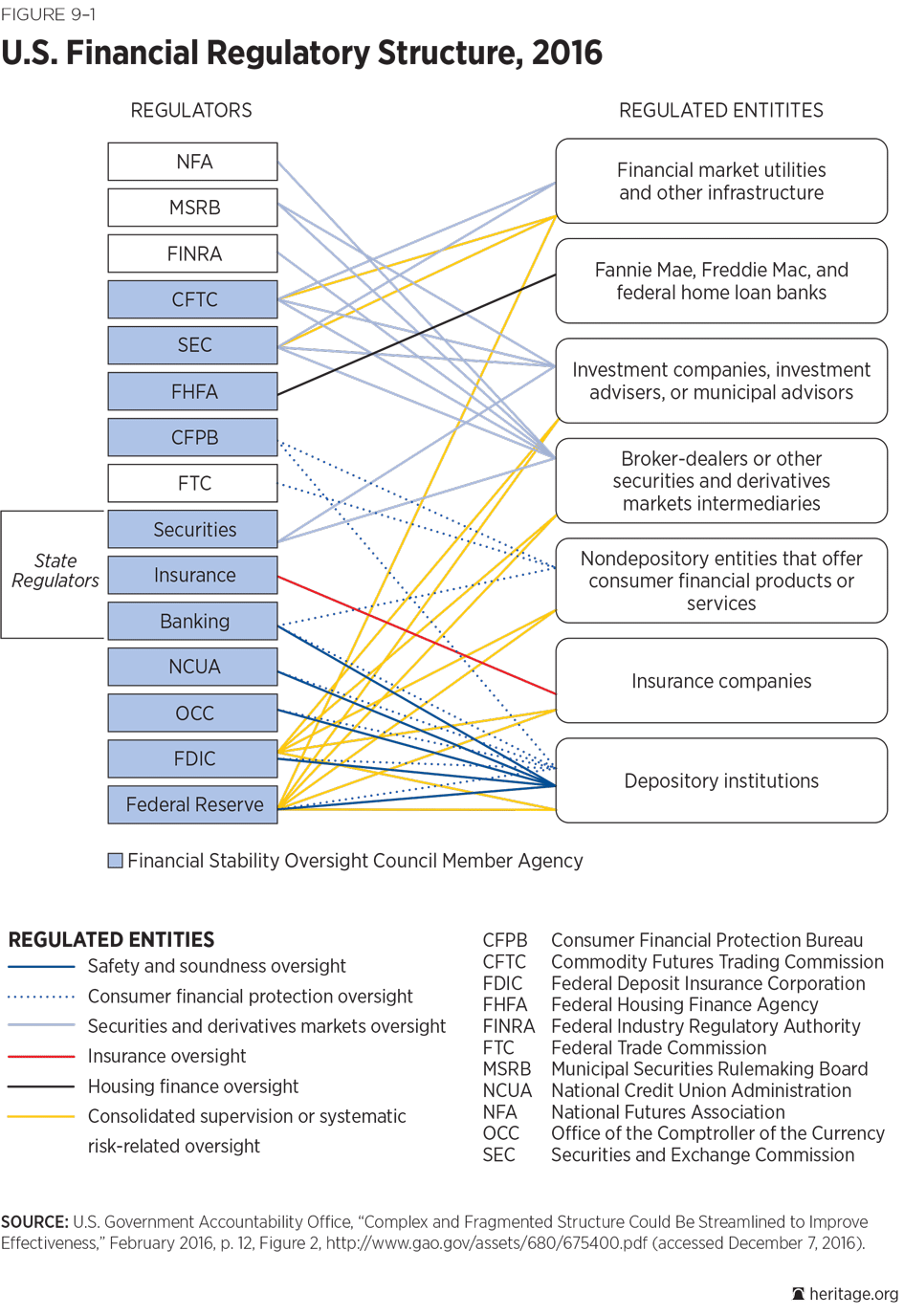

The attempts to consolidate regulators ran into political roadblocks and were dropped in favor of Dodd–Frank’s more politically palatable, but complex, regulatory structure. Nevertheless, Dodd–Frank implemented major changes—most notably the elimination of the Office of Thrift Supervision37 and addition of the Consumer Financial Protection Bureau (CFPB), the FSOC, and the Office of Financial Research (OFR). Naturally, the fact that a large number of regulators remain continues to draw recommendations to consolidate. For example, the Government Accountability Office (GAO) recently issued a comprehensive look at financial regulation completed after the Dodd–Frank Act, and titled the report “Financial Regulation: Complex and Fragmented Structure Could Be Streamlined to Improve Effectiveness.”38 The report explored many ways in which the post-Dodd–Frank regulatory framework results in duplicative and inconsistent regulation. The dizzying array of financial regulators makes attractive the prospect of a super-regulator or—as the Treasury plans recommended—a much smaller set of financial regulators with expanded jurisdiction.

Regulatory diversity, even if not the most efficient approach, however, has certain advantages. First, it allows regulators to specialize in particular types of institutions.39 Second, it allows regulatory experimentation and competition.40 Third, it helps to highlight an error that one regulator is making. Regulators’ decisions can be measured in the context of other regulators’ approaches to similar issues. Fourth, if a regulator does make an error, only the subset of entities it regulates will be directly affected. Fifth, maintaining distinct capital markets and banking regulators provides speed bumps to banking regulators’ efforts to apply bank-like regulation more broadly.41

In short, one of the advantages of the current system is that regulators can be measured against one another, and their mistakes are bounded by the limits of their jurisdiction.42 Competition among regulators can also reduce the possibility that regulators choose the “quiet life” of not raising too many objections about the entities they regulate.43 One of the reasons why the failings of supervision at the Office of Thrift Supervision (OTS) have been so well publicized is the parallel oversight by the FDIC. The material-loss reviews independently conducted by the Inspector General of the Treasury Department have also helped to expose regulatory failings.44 Such reviews should be expanded to cover broader issues of regulatory performance.

One argument for consolidating regulators is to avoid “charter-shopping” or a “race to the bottom” among regulators.45 This argument, however, assumes a degree of competition between financial regulators that is at odds with the existing regulatory system. Many of the institutions at the heart of the crisis, such as the government-sponsored enterprises Fannie Mae and Freddie Mac, had no ability to choose their regulator. While banks and thrifts had some ability to shift their charters, such was only a choice between federal and state or between the Office of the Comptroller of the Currency (OCC) and the OTS.

Contrary to the charter-shopping argument is that, during the recent financial crisis, banks failed at roughly similar rates across the various bank regulators.46 Despite its many well-documented failings, the OTS was not an outlier. Furthermore, as professors Henry Butler and Jonathan Macey have so aptly observed, competition among banking regulators is largely a myth.47 In surveying the literature of state corporate governance and banking laws, one recent article found that such competition did not generally lead to a “race to the bottom” but rather a sorting into alternative regulatory systems.48 While the extent of competition between bank regulators can certainly be debated, the fact remains that state bank regulators may not face the full costs of their decisions, given that banks they charter are ultimately backed by the federal government.49

Streamlining Regulation

Although full regulatory consolidation could harm financial markets, some streamlining is important. The existing regulatory structure embodies certain inefficiencies and redundancies. Regulators coordinate, but “this coordination requires considerable effort that, in a more efficient system, could be directed toward other activities.”50 The following discussion offers some examples of areas in which regulatory consolidation could make financial regulation more effective at achieving its goals and less costly for regulated companies—and ultimately their consumers and investors.

Removing the Federal Reserve’s Regulatory and Supervisory Powers. As the United States central bank, the Federal Reserve’s primary roles are in the monetary policy arena. Specifically, the Federal Reserve Act directs the central bank to “maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates.”51 The Federal Reserve has struggled to fulfill these macroeconomic responsibilities, and its supplementary regulatory and supervisory responsibilities—particularly as they have expanded since the financial crisis52—are simply unnecessary for conducting monetary policy.

First, these responsibilities take the time of the Federal Reserve Board of Governors and staff. The Federal Reserve has been actively engaged in regulation and supervision in the post-crisis years. Second, the chairman of the Federal Reserve is typically chosen for her monetary policy expertise. Expecting the chair to also master a massive regulatory and supervisory portfolio is unreasonable. Dodd–Frank, in conjunction with increasing the responsibilities it placed on the Federal Reserve, established a new, Senate-confirmed position—Vice Chairman for Supervision.53 This as-yet-unfilled position is to be filled by one of the Federal Reserve Governors, whose ability to focus on monetary policy would therefore be attenuated. Third, allowing the same entity to exercise regulatory and monetary functions gives rise to unnecessary and potentially dangerous conflicts of interest. A central bank that is also a regulator and supervisor could be tempted to use monetary policy to compensate for mistakes on the regulatory side, and financial stability concerns could sometimes lead to regulatory forbearance.

Fourth, as discussed earlier, the larger the Fed’s regulatory role, the greater the magnitude of the effects of its policy mistakes. These mistakes will reverberate across the full range of financial institutions, rather than be limited to banks and bank holding companies. Fifth, the Federal Reserve’s responsibilities overlap with those of other financial regulators.54 The overlap results in inconsistencies and duplicative efforts by both regulators and regulated entities.55 Efforts at inducing coordination, including the Federal Financial Institutions Examination Council (FFIEC)56 and the FSOC’s mandate to encourage cooperation among regulators, have not addressed this problem adequately. Removing the Federal Reserve’s regulatory and supervisory powers would allow it to focus on monetary policy. The Federal Reserve’s regulatory and supervisory responsibilities could be shifted to either the OCC or the FDIC.

Repurposing the FSOC and Eliminating the OFR. The missions of two of the new agencies created by Dodd–Frank—the Financial Stability Oversight Council and the Office of Financial Research—do not contribute to the efficacy and efficiency of the financial regulatory system. Dodd–Frank’s framers ambitiously envisioned that the FSOC and OFR would work together to identify systemic risks and prevent them from harming the economy. The FSOC, a more powerful version of the President’s Working Group (PWG) on Financial Markets,57 was a natural result of concerns of poor regulatory coordination leading up to the crisis. The new entity, however, unlike its predecessor, was given regulatory functions. Its key functions include identifying systemically important financial institutions,58 identifying systemically important financial market utilities and activities,59 and making recommendations to other financial regulators.60 Identifying individual firms that pose a systemic risk is a futile mission that serves mostly to strengthen bailout expectations.61 Furthermore, its power to make regulatory recommendations makes other regulators accountable to the FSOC rather than to the President, Congress, or the public.

A more useful mission would look more like that of the PWG—bringing regulators (albeit not exclusively agency heads) together to discuss issues that cut across their jurisdictions. The regulators could share concerns with one another, identify financial market trends, and play a valuable role in discussing ways in which regulators’ actions are complementary or conflicting. A more collegial mission would avoid some of the problems that the FSOC has exhibited to date, such as imposing a bank-centric view, an undue deference to foreign regulators, and a tendency to perpetuate too-big-to-fail expectations.62

The OFR, although rarely the subject of much public attention, has the potential to impose substantial pecuniary and privacy costs on the financial industry and the American public without clear benefits.63 The OFR director has the authority to collect (including by subpoena) data from financial companies and has broad power to share that information with the industry.64 Regulated financial firms cannot hide data from their primary regulators, so it was unnecessary to create a new government agency for such a narrow regulatory purpose. Creating a new agency, such as the OFR, with broad powers and very little accountability, was entirely unwarranted. While some have suggested refocusing the OFR so that it that could assess “the impact of regulation on economic growth as well as the impacts of the financial system and financial regulation on consumers and businesses,”65 all existing financial regulators—in addition to the Congressional Budget Office and the Office of Management and Budget—can already conduct such assessments.

If the PWG was ineffective, thus necessitating a new agency created via legislation, Congress should formally ask the President to rescind the executive order that created the PWG. Then, Congress should eliminate the OFR, and also restructure the FSOC so that it is nothing more than a regulatory council for sharing information. In particular, Congress should reorient the FSOC so that its only responsibility is to provide a mechanism for financial regulators to formally share information.66 Because these agencies are charged with broad powers to maintain financial stability, the FSOC and the OFR have the perverse effect of lessening market discipline, which runs directly counter to their stated purposes.67

Consideration of an SEC–CFTC Merger. The SEC and CFTC regulate markets that have increasingly blurred into one another over the years. Yet the two agencies have approached their regulatory responsibilities in different and sometimes conflicting ways, causing market participants to struggle to navigate the resulting regulatory morass.68 There is a theoretical case for allowing the two regulators, which historically have taken very different regulatory approaches,69 to exist side-by-side. If one regulator’s approach is flawed, for instance, regulated entities may be able to migrate to the markets in the other regulator’s purview. In practice, however, the bifurcated responsibility has resulted in tense regulatory battles and duplicative effort by regulators and market participants.

Periodic attempts to address the problem have helped calm some of the interagency fighting, but the agencies’ closely related mandates promise continued discord.70 For example, the Shad–Johnson Jurisdictional Accord of the early 1980s brought a measure of peace, but jurisdictional disputes continued. Dodd–Frank, which awkwardly split regulatory responsibility for the over-the-counter derivatives market between the two agencies, only compounded the problem with overlapping authorities.71 The CFTC, although built on the hedging of agricultural commodities, now is primarily a financial markets regulator. The markets it regulates are closely tied—through common participants and common purposes—with SEC-regulated markets. The U.S. is unusual in having separate regulators for these markets.

A merged SEC and CFTC might be better able to take a holistic view of the capital and risk-transfer markets. A single regulator could conserve resources in overseeing entities that are currently subject to oversight by both the SEC and CFTC. In addition, a unified regulator would eliminate discrepancies in the regulatory approaches that can frustrate good-faith attempts by firms to comply with the law. Cultural differences between the agencies could initially make such a merger messy,72 but serious consideration of a merger of the two entities is long overdue.73 In order to facilitate such a merger, Congress could consider creating a joint committee, composed of members from both the agriculture and banking committees, to oversee the new merged agency.

Transferring Department of Labor Investment Regulatory Authority to the SEC. Although not included in a typical list of financial regulators, the Department of Labor plays an increasingly important role in financial regulation. Specifically, under the Employee Retirement Income Security Act of 1974 (ERISA),74 the Labor Department regulates private pension plans; the department also has some regulatory authority over individual retirement accounts (IRAs).75 The Labor Department regulates interactions of financial professionals with these tax-advantaged plans and the retail investors that rely on them to save for their retirement.

The Labor Department’s financial regulatory role has recently attracted particular attention in connection with a controversial rule-making related to financial professionals working with retail retirement investors.76 The rule-making changes the way broker-dealers and other financial firms interact with clients, the way financial firms are compensated, the disclosures these firms must make, the records they must keep, and the liability they face.77 It also may change the availability and cost of financial services.

The breadth of the rule and the novelty of the standards it applies mean that it will govern much of the retail financial services industry. Because of the importance of ERISA plans and IRAs, the changes made in this context will spill over into other contexts and likely overshadow any potential future rule-making by the SEC regarding a broker-dealer’s standard of care. The Labor Department’s rule-making occupies a space—retail investors’ interactions with their financial professionals—that more naturally belongs to the SEC, and the Labor Department’s rules may conflict with SEC rule-making. Given the SEC’s greater experience in regulating broker-dealers and investment advisers, Congress should shift responsibility for regulating the relationship between pension plan and IRA investors and their fiduciaries to the SEC.

Reconsidering the Nature of Self-Regulation. Self-regulatory organizations (SROs) are a key set of players in the U.S. financial regulatory landscape. These organizations include securities and futures exchanges, the Financial Industry Regulatory Authority (FINRA), the National Futures Association, and the Municipal Securities Rulemaking Board (MSRB).78 These entities are rooted in the notion that market participants have an incentive to self-regulate to maintain the integrity of the markets and customer trust. If members of an industry collectively set and enforce strong standards, investors will have the necessary confidence to participate in markets. For example, a stock exchange regulates its listed companies to make those companies and hence its marketplace more attractive to investors.79 FINRA (like its predecessor entity, the National Association of Securities Dealers) regulates brokerage firms and their employees to ensure that customers are comfortable trusting them with their money.

Over time, self-regulation has changed. These self-regulators have begun to look more governmental, and the industry’s tether on the governance of these organizations has loosened.80 In large part, this change is due to a tendency by regulators to formally delegate responsibilities to these private organizations. The change is also driven by a fear that, left to themselves, industry members will be too lenient. History shows, however, that self-regulation in its more traditional form can work well.

Financial firms rely heavily on reputation, so they have an incentive to maintain strong standards to ensure that customers feel comfortable dealing with them. That incentive would be particularly strong if there are competing SROs that market themselves on the quality of the standards they maintain. Competition among SROs obviates the need for the government to micromanage the approaches that SROs take. SROs can experiment with different approaches, and customers can choose the SRO that establishes the level and nature of regulation they prefer.

Allowing Federal Pre-Emption and State Reciprocity. The financial services marketplace is increasingly national, but much of the regulatory structure is still state based. A state-based approach can work for products and services that are offered locally. It can also work for national markets, as it does in the corporate chartering space, where companies choose their state of incorporation and that state’s laws govern the company’s relationships with its shareholders wherever they reside.81 In much of financial regulation, however, the model is more complicated—a company must satisfy the laws of every state in which it operates. The Internet conveniently matches customers with far-flung financial service providers, but also exposes companies to the legal risk arising from potential violations of every customer’s state laws.82

The process of learning which obligations apply in each state and coming into compliance is burdensome, particularly for would-be new entrants, and the burden of state-by-state compliance is especially evident in the marketplace-lending and securities sectors.83 In some markets, a better model is federal pre-emption of state law or, alternatively, state “passporting,” which allows a company that complies with one state’s laws to operate across the nation. Both of these approaches ensure that financial companies are regulated, but they also streamline the regulation and avoid duplicative and overlapping regulation.

Considering a State-Based Competitive Model for Insurance Regulation. The troubles of American International Group (AIG) during 2008 that prompted the government to rush to the aid of the company and its creditors renewed questions about the existing system of insurance regulation. Dodd–Frank, although widely characterized as not having substantially altered insurance regulation, added a new layer of federal regulation that is likely to expand over time.84 The FSOC can designate—and has designated—insurance companies as systemically important and thus subject to Federal Reserve regulation. The Federal Insurance Office can negotiate international agreements that override state law. Prior to Dodd–Frank, the existing state regulatory system subjected insurers to multiple state regulators. Thus, by adding a more active role for federal regulators, Dodd–Frank increased the regulatory hurdles to competition in the insurance industry.

In the past, there have been calls for a federal insurance charter to streamline regulations. An optional federal charter would, for instance, enable nationwide insurers to avoid the hassle of dealing with multiple state regulators.85 However, a federal charter would increase the temptation of federal policymakers to wrap insurance companies into the federal safety net, thus increasing moral hazard problems in the industry.86 In addition, insurance-regulation expertise largely resides at the state level. Building a new federal bureaucracy seems wasteful, although the process is already underway due to Dodd–Frank.

A state-based approach might be more effective and less costly than federal regulation. The state model has succeeded in the corporate-law area, whereby companies are chartered in and governed by the laws of a single state. Delaware courts have developed particular expertise in dealing with corporate law matters, and other states can experiment with different approaches.87 Professors Henry Butler and Larry Ribstein have argued that a similar state-based competitive approach could work in the insurance context.88 Under such a model, an insurer would only have to be licensed in one state to operate nationwide. States, competing for chartering revenues, would have an incentive to design effective regulatory systems and to refine them in response to changes in the industry.

Butler and Ribstein further propose supplementing the existing state-guaranty funds with solvency bonds the value of which would fluctuate in response to the market’s assessment of the efficacy of a state’s insurance regulation, and that would default upon failure of the fund.89 These bonds also would play a role in signaling market participants’ beliefs that one of the state’s large insurers was in trouble. Such a state-based system would build on states’ regulatory expertise in insurance, while obviating the need for a new federal regulator and the likely associated expansion of future federal bailouts.

Rethinking Agency Structure, Funding, and Accountability

In addition to thoughtful consolidation and reorganization of regulatory authority, policymakers should consider procedural changes to strengthen financial regulation. Who makes rules and the nature of the process by which they are made influence the effectiveness of those regulations. This section sets forth some principles of sound regulatory and procedural design.

Improving Accountability Through Structure and Funding. The way a financial-regulation agency is structured and funded affects its accountability and therefore the quality of its regulation. Typically, agencies are accountable to the President, who directs their actions, and Congress, which controls their funding. Many financial regulators do not fit this mold because historically they have been funded by assessments on the firms they regulate, and in some instances have been outside the traditional congressional appropriations process. The reliance on industry assessments for funding can also distort regulators’ incentives, particularly when a small number of institutions constitute a large percentage of the assessment base.

At the time of its failure, assessments on Washington Mutual constituted just over 12 percent of the OTS budget.90 At one extreme, the entire budget of the Office of Federal Housing Enterprise Oversight was derived from two companies: Fannie Mae and Freddie Mac. As the financial services industry continues to consolidate, these incentives will only become more perverse. Due to peculiarities of funding and structure, these agencies tend to be less politically accountable than many of their non-financial counterparts. Greater accountability can be introduced by, for example, subjecting financial regulators to appropriations and implementing a commission governing structure.

Regulatory structure has drawn much attention recently on account of two new Dodd-Frank regulators’ unusual design. The CFPB is a single-director agency with complete autonomy from its host agency and, more important, little accountability to Congress and the President.91 The FSOC comprises the heads of the federal financial regulators, an insurance expert, the head of the Federal Insurance Office, and some state regulators. The FSOC depends on the OFR for funding. The FSOC’s structure poses a number of problems: (1) The presence of state officials raises potential constitutional concerns; (2) the exclusion of non-chair members of financial regulators gives undue power to the chairmen of those agencies; and (3) the ability of the FSOC to force independent regulators to act undermines the independence of those agencies.

The design and funding of other financial regulators also give rise to accountability concerns. The OCC, Federal Housing Finance Agency (FHFA), and OFR have some of the same markers of autonomy as the CFPB—a single director, funding autonomy, and, in the case of the OCC and OFR—no accountability to the Treasury Department of which they are part. The Federal Reserve is governed by a board, but enjoys a high degree of independence from accountability.

Because financial regulators are deeply involved in setting financial policy, rather than just implementing laws and supervising financial institutions, political accountability is important. As the mandates and scope of discretion of these agencies expands, the need for accountability also increases. Furthermore, agencies designed to be independent of outside influence are not the most effective regulators.92 The CFPB, OCC, and FHFA will better incorporate a broad range of policy views if they are governed by multimember boards with mandatory political balance. Such a structure will help to ensure policy continuity over time, thus affording the industries they regulate and the public greater certainty about the future of the financial markets. The CFTC and SEC, both of which are governed by five-member politically balanced commissions, can serve as models in this regard.

Congress’s greatest ability to guide and direct regulators comes through the appropriations process. Even though the SEC is funded through fees paid by the industry, Congress can determine how much the SEC can spend. The Congressional Research Service explains how “the annual appropriation processes and periodic reauthorization legislation provide Congress with opportunities to influence the size, scope, priorities, and activities of an agency.”93 We propose that all financial regulatory activity be funded via the appropriations process, which would reduce the perverse incentives that arise from having regulators’ budgets so heavily dependent on a small number of entities. The appropriations process also provides an important avenue for additional congressional oversight that can complement the oversight process of the Senate Committee on Banking, Housing, and Urban Affairs and House Financial Services Committees.

Opponents of this view fear that Congress might cut regulatory budgets to curtail agencies’ ability to supervise financial firms, but this argument is a broader critique of Congress’s ability to make sound decisions. Furthermore, there is no reason to anticipate better decision making, relative to private market participants, from the unelected heads of federal regulators. Federal regulators should be conformed to the constitutional allocation of the appropriations power to Congress.94 While Congress is subject to its own failings, this process improves accountability because Members of Congress can be removed at the ballot box, whereas financial regulators have historically faced little public accountability for their failures.

Increasing Congressional Accountability for Regulation. In Dodd–Frank, Congress delegated to financial regulators the job of filling in many important aspects of the post-crisis regulatory framework. Within that broad authority, regulators have written rules that impose substantial costs on financial institutions and their customers. Because of how important these delegations are, congressional review of the completed rules is necessary to ensure that they achieve congressional objectives. The Congressional Review Act allows Congress to overturn major agency rules before they take effect.

Requiring Congress to sign off on major financial regulations would ensure that this review actually happens and is not merely perfunctory; congressional failure to approve a rule would preclude it from going into effect. Such an approach has been proposed in Congress.95 A congressional review requirement for major rules would recognize the reality that many of the meaningful decisions about financial regulation are currently delegated to regulatory agencies. Allowing political review of these decisions would provide a political check on unelected officials. Requiring Congress to affirmatively assent to a rule after the contours and nuances of the rule are defined would allow Congress to take into account the new information generated in the rule-making process. Congress would also be reluctant to approve a rule the costs of which exceeded the benefits.

Mandating Economic Analysis. As a counterpart to enhanced congressional review, financial regulation would be improved by a requirement that regulators conduct more robust economic analysis. Regulatory scholar Jerry Ellig explains that “legislators [cannot] make a responsible decision to approve or disapprove a regulation if they do not know whether the regulation solves a real problem or whether there is a better alternative solution than the proposed regulation.”96 These are questions that a proper economic analysis answers.

Financial regulators, many of which are structured as independent regulatory agencies, do not have a strong tradition of economic analysis. They are not subject to the regulatory impact-analysis requirement applicable to executive branch agencies97 and, with only a few exceptions, their organic statutes do not require economic analysis. Financial regulators, bolstered by academic arguments that financial regulation does not lend itself to economic analysis, have tended to downplay their limited statutory obligations to conduct cost-benefit analysis. As a consequence, financial regulators are regulating in the dark—deprived of the light that economic analysis would shed on the consequences of regulation and alternatives available to them.

Economic analysis is a useful rule-making tool. It allows regulators to assess the nature and magnitude of a problem, determine whether regulation is an appropriate response, and—if it is—assess alternative regulatory solutions. This tool is as helpful for financial regulators as it is for other regulators.98 A congressional mandate to conduct economic analysis, backed by a judicial-review requirement, would help to ensure that regulators have access to the information they need to think through regulatory problems and design effective solutions.

Resisting Internationalization. The international character of the financial markets has naturally led to cross-border regulatory cooperation and coordination. The financial system generally benefits from these transnational efforts. In recent years, however, international cooperation has increasingly resulted in what are effectively mandates crafted at the international level for domestic application. Organizations like the Group of 20, the Financial Stability Board (FSB), the International Organization of Securities Commissions, and the International Association of Insurance Supervisors issue statements that reflect a common understanding of appropriate regulatory approaches. The implicit—and sometimes explicit—understanding among participants in some of these groups is that group decisions will be translated into domestic regulations.99

Cooperation and conversation with foreign regulators is important, but commitments cannot be made internationally to take particular domestic regulatory actions.100 Doing so cedes sovereignty over domestic financial regulation. It also violates Administrative Procedure Act (APA) requirements that regulations be the product of a public notice and comment rule-making process. To maintain the integrity of the domestic rule-making process, financial regulators should be precluded from making international pre-arrangements about what regulations should be and to which entities they should apply.

Requiring Transparent and Tested Rule-Making. Rule-making through international cooperation is not the only way that financial regulators evade the APA. The APA requires agencies, before imposing new regulatory obligations, to publish a proposal, seek public comment on that proposal, and to consider the feedback in developing its final rule-making.101 Dodd–Frank placed heavy rule-writing requirements on financial regulators.102

Faced with so many statutory mandates, financial regulators have been particularly tempted to cut corners by supplementing their regulatory activity with less-formal means than the standard notice-and-comment rule-making.103 These methods include regulating through staff letters, enforcement actions, guidance documents, examination findings, and even speeches.104 Although not technically binding, regulators can force change in the industry without engaging in a transparent discussion with the public about the costs and benefits of the change, as well as potential superior alternatives.

Regulators should use transparent rule-making methods that are consistent with the APA to regulate financial markets. Notice-and-comment rule-making is time-consuming and expensive, but it generates benefits for the agency, regulated entities, and the public that is supposed to benefit from regulation. Government agencies have limited information, and putting a proposal out for public comment generates additional information. The public may, for instance, raise awareness of costs, benefits, alternatives, or interactions with other rules that the regulator had not considered.105 Commenters can also challenge the assumptions underlying the rule and fill in data gaps in the proposal. The notice-and-comment process is particularly important when Congress makes broad delegations to agencies, thus leaving the regulators—which are not as accountable to the public as Congress—with leeway to craft rules in a way that may particularly affect certain groups of consumers or firms. To raise the quality of regulation, financial regulators should be held to the standard set forth in the APA.

Dis-Embedding Bank Examiners. Financial-industry supervisors often work in the offices of the companies they oversee and report daily to those firms.106 While this practice enables supervisors to get to know the people, practices, and culture of the companies they supervise, embedded supervision also breeds capture. Moreover, it is an outgrowth of the flawed notion that banks (and, increasingly, other financial institutions) are different from other companies and need government micromanagement. This intensive, long-term engagement with regulated entities suggests to the entities’ managers, shareholders, and customers that firm decision making is blessed by the regulators. It thus shifts responsibility from the private sector to the government sector. A better approach would not rely on permanent on-site supervision, but on targeted inspections.

Facilitating Innovation. Financial regulators, as other regulators, have an incentive not to approve innovation. By approving innovation, they expose themselves to future criticism if the innovation is later associated with customer harm. Thus, a rational regulator might delay or deny requests to make the legal accommodations necessary for new financial products and services. Naturally, the financial industry’s ability to serve the rest of the economy suffers from regulatory roadblocks to innovation. These natural anti-innovation tendencies have drawn public attention, and some regulators have looked at ways to counteract the problem.

The United Kingdom’s Financial Conduct Authority (FCA), for example, set up a “regulatory sandbox,” which the FCA defines as “a ‘safe space’ in which businesses can test innovative products, services, business models and delivery mechanisms in a live environment without immediately incurring all the normal regulatory consequences of engaging in the activity in question.”107 Similarly, the CFPB established Project Catalyst, which offers joint CFPB–financial-company pilot programs108 and staff “no action” letters to provide a temporary promise not to recommend an enforcement action “for a new product or service that offers the potential for significant consumer-friendly innovation.”109 The OCC, acknowledging a “low risk tolerance for innovative products and services,”110 has also indicated a new openness to financial technology.111 Among other things, it is considering offering a special charter for FinTech companies.112

Although the regulatory desire to lower barriers to innovation is commendable, the approaches that regulators are using raise concerns. The regulators, by asking financial companies to prove that their innovations will benefit consumers113 or that their innovations are “responsible,”114 are placing themselves in the role of the market. Regulators need not make these assessments; if they allow companies to innovate, consumers will decide which innovations they like. When a regulator tries to usurp this market function to screen out bad products, it inhibits innovation.

Financial regulators, therefore, should look for ways to make it easier for financial firms to develop new products regardless of whether the regulator thinks the effort will be successful. Making a concerted effort to modify existing rules so they accommodate new technologies and taking care to avoid cementing a particular technology into new rules are two ways regulators can foster innovation without attempting to direct it. An individual or office within a regulator that is charged with shepherding products through the difficult-to-navigate approval process could also help, but financial regulators’ overall approach toward innovation must change. CFTC Commissioner Christopher Giancarlo put it succinctly when he called for a “do no harm” approach that “open[s] wider our agency doors and regulatory minds to benefit from FinTech innovation.”115

Thriving innovation can reshape the financial industry so dramatically that the notion of banks being special falls by the wayside. When that happens, the door to regulatory innovation will also be open wide.

Removing Failed Regulators

Financial regulators are subject to failure, just as market participants are. Private-sector failure is met with market discipline, but because of the muted accountability mechanisms in government, regulatory failure is rarely punished. After the financial crisis, regulators who had not performed well were rewarded with new jurisdiction and powers. An effective financial regulatory system holds regulatory bodies and the people that lead and staff them responsible for their failures and rewards them for their successes.

Appropriate incentives for regulators will encourage them to perform their jobs carefully and diligently. Regulators should not be punished when regulated entities or regulated products and services fail—failure is a natural occurrence in properly functioning market systems. Regulators should be held responsible for decisions that induce, abet, or cover up failure.

Conclusion

This chapter takes a broad view of the financial regulatory framework. Far from being the product of a careful architect, the regulatory system has been built in pieces. The result is much like a house, each successive owner of which has fitted it with an awkward addition in the style of the time. The resulting house is an eyesore that does not accommodate the needs of its current occupants. We have attempted here to suggest some areas that could benefit from reorganization—consolidating related powers in one regulator, removing authorities from agencies ill-equipped to perform them, and revamping processes to ensure appropriate accountability for and public input in rule-making.

No comments:

Post a Comment